Beneficial

Swift and hassle-free financial solutions available wherever you are

Swift and hassle-free financial solutions available wherever you are

We prioritize the protection of your personal information and support

Experience immediate fund transfers and customizable loan terms

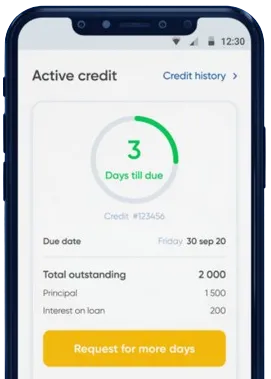

Easily apply for a loan through our app by completing a simple and quick form.

Stay tuned for our swift decision, typically delivered within just 10-15 minutes.

Access your money seamlessly, with transactions often processed in under one minute.

Send in your loan application using our app by filling out a quick form.

Download loan app

In Kenya, financial emergencies often strike without warning, leaving individuals in need of immediate financial assistance. An urgent loan of 10,000 Kenyan shillings provides a practical solution for those who require quick funds to address pressing needs. This type of loan has gained popularity for its accessibility, speed, and convenience, making it an invaluable resource in challenging times.

When faced with an unexpected situation, many people find themselves asking, "I need a loan urgently." This sentiment is common during emergencies such as medical expenses, car repairs, or unforeseen bills. Traditional banking options often fail to provide the speed and simplicity required in such circumstances. This is where online emergency loans in Kenya come into play, offering a streamlined application process and rapid approval timelines.

Applying for a loan has never been easier with the advent of digital platforms. These services eliminate the need to visit physical branches or submit lengthy paperwork. Borrowers can now access loan applications online from their smartphones or computers, ensuring convenience and efficiency. This is particularly beneficial for those with tight schedules or limited access to transportation.

An urgent loan of 10,000 shillings is tailored to meet the financial needs of individuals who require immediate support. These loans are designed to be accessible to a wide range of borrowers, regardless of their credit history. They do not require collateral, making them a viable option for individuals who may not have assets to pledge. Additionally, lenders in Kenya offer flexible repayment terms, allowing borrowers to repay the amount over a period that suits their financial situation.

The speed of disbursement is one of the defining features of this type of loan. Upon approval, funds are often transferred within minutes, ensuring borrowers can address their needs without delay. This immediacy makes urgent loans particularly effective in situations where time is of the essence.

Another advantage is the versatility of these loans. Whether you need to pay for emergency expenses, consolidate debt, or cover daily necessities, this solution provides the flexibility to meet various financial demands. With platforms like M-Pesa, the funds can be transferred directly into mobile wallets, enabling users to access their money instantly and conveniently.

The digital age has transformed the lending landscape, making online emergency loans in Kenya a popular choice for many. These loans cater specifically to individuals seeking fast, hassle-free financial assistance. Unlike traditional loans, online options often have minimal requirements, allowing more people to qualify for support.

One key feature of online emergency loans is their user-friendly application process. Borrowers are guided through simple forms that take only minutes to complete. The required documentation is minimal, often limited to proof of identity and income. This simplicity ensures that even first-time borrowers can navigate the process with ease.

Data security is a top priority for online lenders, ensuring that personal and financial information is safeguarded. With advanced encryption technologies, borrowers can feel confident that their details are protected from unauthorized access. This commitment to security has contributed to the growing trust in online lending platforms among Kenyan users.

Finding a reliable source for urgent loans is crucial during financial emergencies when you think "I need a loan urgently in kenya!". Online platforms specializing in quick loans have become a go-to option for many Kenyans. These platforms are designed to offer fast approvals and seamless fund transfers, ensuring that borrowers can address their needs without unnecessary delays.

Mobile payment systems like M-Pesa further enhance the accessibility of loans. By integrating loan disbursement with mobile wallets, platforms provide a convenient way to receive funds. This is particularly beneficial for those living in remote areas or without access to traditional banking services. With features like MPesa app free 10,000 loan online, the process is made even more user-friendly.

In addition to online platforms, microfinance institutions and credit unions also offer solutions for urgent financial needs. These organizations often provide personalized service and flexible repayment options, making them a viable alternative to larger banks. Borrowers seeking immediate funds can explore these options to find the best fit for their circumstances.

When the need for immediate financial assistance arises, knowing where to get money urgently is essential. Several options are available to Kenyans looking for fast and reliable solutions. Online lenders remain the top choice due to their speed and convenience. These platforms cater to a wide range of financial needs, from small personal loans to larger amounts for significant expenses.

Microfinance institutions also play a crucial role in providing access to urgent funds. These organizations are community-focused, offering tailored solutions that address the specific needs of their members. They are particularly useful for borrowers who may not qualify for loans from larger financial institutions.

For those wondering, "Where can I borrow money urgently in Kenya?" platforms integrated with mobile payment systems offer an unbeatable combination of speed and accessibility. These services have become indispensable for individuals needing fast financial relief. With an urgent loan of 10,000, users can cover immediate expenses and avoid prolonged financial strain.

It’s important to approach borrowing responsibly. Understanding the terms and conditions, comparing interest rates, and evaluating your repayment capacity are critical steps before committing to a loan. This ensures that the loan serves its intended purpose without creating long-term financial challenges.

Choosing an urgent loan comes with several advantages, making it a reliable choice for those in need of fast financial assistance. These benefits include:

These features ensure that urgent loans provide a seamless and accessible solution for a variety of financial needs.

Urgent loans of 10,000 shillings provide a lifeline for Kenyans facing financial emergencies. These loans are designed to offer swift and reliable support, enabling individuals to manage unexpected expenses effectively. The rise of online emergency loans in Kenya has made accessing funds more convenient than ever, with platforms offering seamless applications, fast approvals, and instant disbursements.

By leveraging technology, services like M-Pesa have further simplified the process, allowing borrowers to access their money with ease. Whether you’re seeking a loan online or exploring other options, finding a trustworthy lender is crucial. Ensuring that the loan terms align with your financial situation can help you make the most of this resource while avoiding unnecessary stress.

From addressing immediate needs to bridging financial gaps, urgent loans have become an essential tool for many Kenyans. As you navigate your options, remember to borrow responsibly and prioritize solutions that align with your financial goals. With proper planning and informed decisions, these loans can provide the support you need to overcome financial challenges and secure stability.

An urgent loan of 10,000 in Kenya is a type of loan that is typically processed quickly and is available for individuals who need immediate access to funds.

You can apply for an urgent loan of 10,000 in Kenya by visiting the website of a reputable lender, filling out the online application form, and providing the necessary documents such as proof of income and identification.

The eligibility criteria for an urgent loan of 10,000 in Kenya may vary depending on the lender, but typically include being a Kenyan citizen or resident, having a regular source of income, and being over a certain age (usually 18 years old).

Some lenders in Kenya may offer urgent loan 10,000 to individuals with bad credit, but the interest rates and terms may be less favorable compared to those with good credit.

The typical repayment period for an urgent loan of 10,000 in Kenya can range from a few weeks to several months, depending on the lender's terms and conditions.

If you are unable to repay the urgent loan of 10,000 in Kenya on time, you may incur additional fees and interest charges, and it could negatively impact your credit score.